News

The Latest

BoA Windturbine Letter

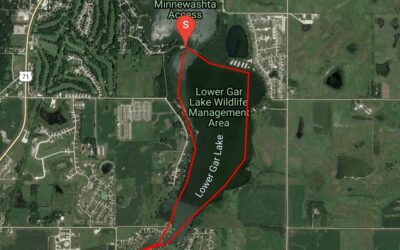

Milford City Council Approves Agreement for Bridge at Lower Gar Outlet

On Tuesday, October 11th the Milford City Council approved an agreement with Dickinson County with regards to the outlet at Lower Gar. The county will replace some of the culverts with a bridge. IGLA's own Bill VanOrsdel is thrilled with the development as our...

DNR Discourages Swimming at Emerson Bay Due To Bacteria Levels

Spirit Lake, IA (KICD 107.7 Radio)– A public beach in the Iowa Great Lakes has a swimming advisory headed into the last weekend before labor Day. The Iowa DNR does periodic tests at public beaches, and the last test on Wednesday indicates a higher than normal level of...

Facebook Posts

This message is only visible to admins.

Problem displaying Facebook posts. Backup cache in use.

Click to show error

Problem displaying Facebook posts. Backup cache in use.

Click to show error

Error: (#200) Provide valid app ID Type: OAuthException